New ATO tax concessions give ECEC services a chance to save

As part of the Coronavirus Economic Response Package Omnibus Bill 2020 the Federal Government has introduced a number of initiatives designed to support businesses to withstand and recover from the economic impact of the COVID-19.

One of these initiatives is focussed on improving incentives for business owners to spend money on capital items such as resources, furniture, vehicles or IT equipment, for use in their business operations. In exchange for making the investment, the ATO will then allow the business owners to write off a greater amount of value of the assets purchased against their taxable income for the year, and in so doing, reduce taxes paid.

Called the Instant Asset Write-off (IAWO), the old threshold per asset of $30,000 has now been replaced and increased to $150,000 per asset.

This means that if an early education and care (ECEC) service decides to upgrade their furniture and resources and the cost of doing so exceeds $30,000 but is below $150,000 they can now take the full cost and set it off against their taxable income and in turn pay less tax for the year.

Commenting on the improved incentives Paul Mitchell, Group General Manager of Sales and Marketing at Modern Teaching Aids Pty Ltd said “Since the Federal Government announced the increase in the IAWO, we have had enquiries on ways early childhood education and care (ECEC) services could utilise this opportunity.”

Mr Mitchell suggested that there are a number of ways in which services might consider utilising this opportunity, including;

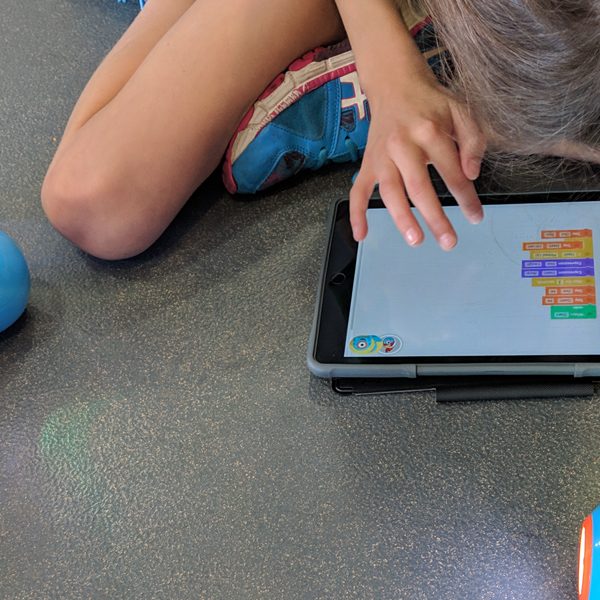

- Creating a STEM area

- Developing an atelier/art studio

- Refurbishing a service with resources from a variety of MTA ranges including Furniture and Storage, Construction and Engineering or Outside and Active

For example, if the owner of a long day care service wanted to take advantage of IAWO at the end of this financial year (i.e: before 30 June 2020) to completely refurbish their centre, they could replace the existing furniture and educational resources across the centre, install a new atelier and construct a new quad play pod for the yard, at a total cost of $65,000 and offset all of this cost against their taxable income at the end of the financial year (EOFY).

From a financial perspective, if their taxable income for the year before the IAWO was $150,000, after the IAWO it would fall to $85,000 as the full cost of the purchases is written off, resulting in total tax payable of $23,375 for the year.

If the IAWO threshold had not been increased from $30,000 to $150,000 the tax payable would have been $6,625 higher for the year despite the purchases being exactly the same.

The new rules will be in place until 30 June 2020, after which it is expected that the thresholds will be reduced back down towards pre-COVID levels and the savings will subsequently disappear.

Please note that there are eligibility criteria for the IAWO and it is understood that the items would need to be installed and ready for use before claiming. It is recommended that a tax advisor is contacted before engaging with the program.

To read more about the IAWO please click here.

Popular

Policy

Quality

Practice

Provider

Research

Workforce

ECEC services to close early for mandatory child safety training under national reforms

2025-12-01 07:10:09

by Fiona Alston

Quality

Policy

Practice

Provider

Workforce

Growth restrictions and enhanced oversight imposed on Affinity Education Group in NSW

2025-12-01 07:30:29

by Fiona Alston

Workforce

Events News

Policy

Practice

Provider

Quality

Gold Walkley Award win for childcare investigation places national spotlight on safety and accountability in ECEC

2025-12-02 07:30:34

by Fiona Alston