Charter Hall Social Infrastructure reports FY21 results, continues pivot away from ECEC

The Charter Hall Social Infrastructure REIT has reported a 13.5 per cent increase in operating earnings in its FY2021 full year results as it continues to execute on its stated goal to diversify away from early childhood education and care assets (ECEC) as the key driver of portfolio performance.

Over the course of FY2021 the Trust’s ECEC portfolio contracted by 35 centres with the proceeds, as well as existing resources on balance sheet, being recycled into two non ECEC assets namely Queensland based not for profit health provider Mater’s corporate headquarters and training facilities and the new South Australian Emergency Services Command Centre that will be leased to the State Government.

Charter Hall Social Infrastructure REIT’s Fund Manager, Travis Butcher said, “It has been an active year which has included the acquisition of two new social infrastructure properties with strong tenant covenants.”

“CQE has continued delivering on its strategy of enhancing income resilience and capital growth.”

Strategy shift away from ECEC increasingly evident in portfolio metrics

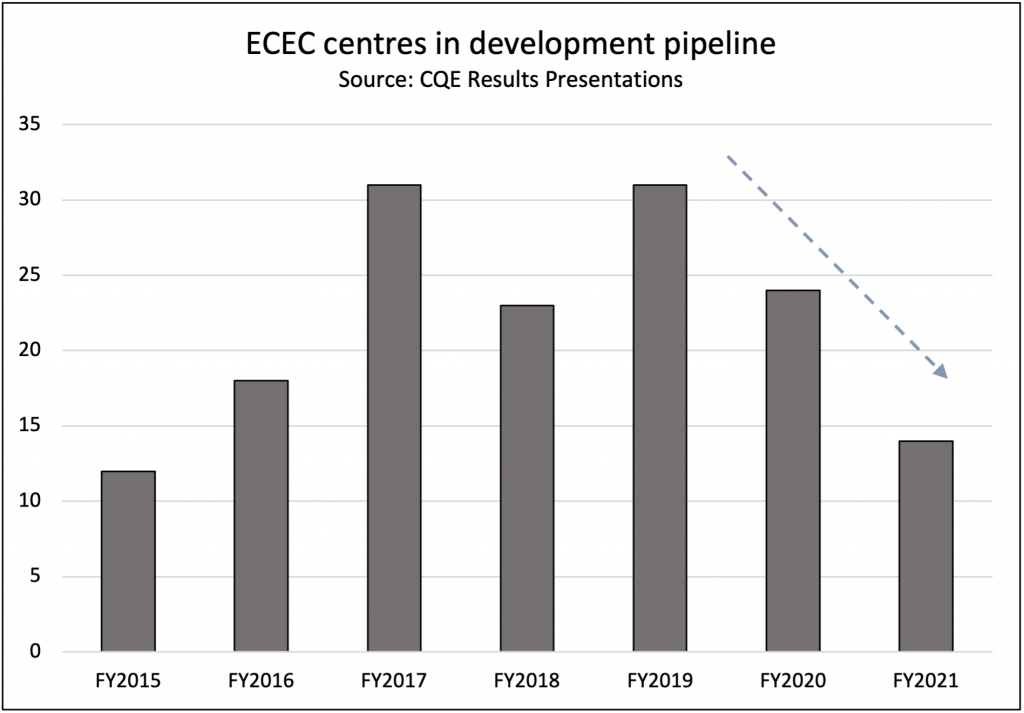

The Group’s ECEC portfolio now stands at 306 freehold centres, around 15 per cent lower than reported at their full year results in 2019, after an active year of disposals which saw 44 centres sold for proceeds of $85.3 million, including the remaining 20 New Zealand centres.

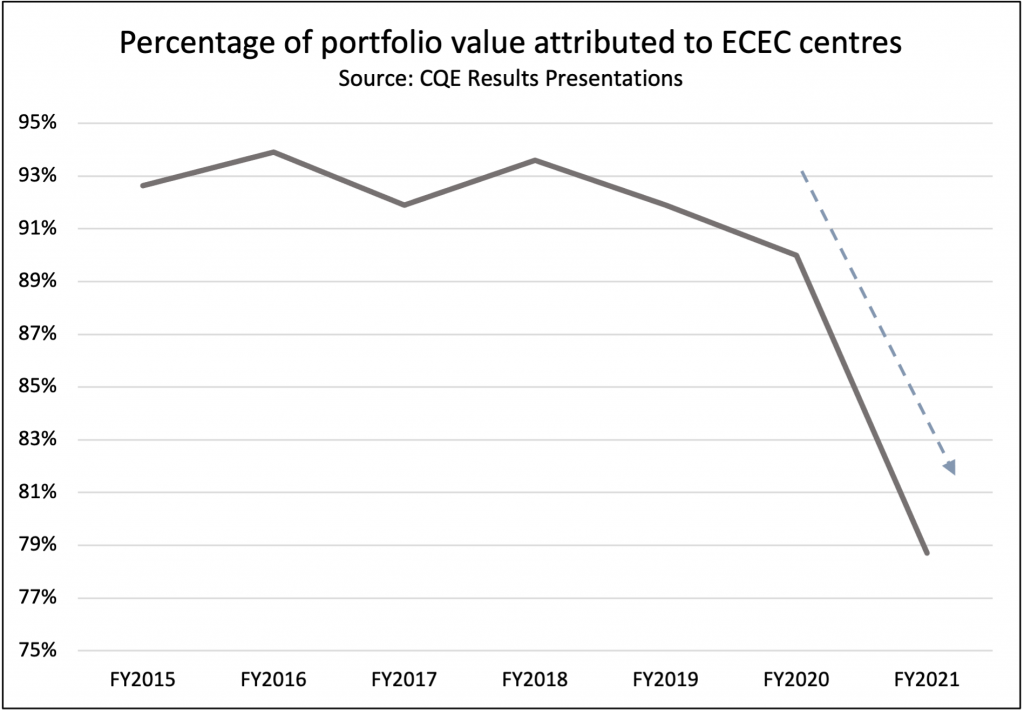

The ECEC portfolio valuation, including the 33 leased centres, now stands at $1.2 billion which represents around 79 per cent of the total portfolio value that includes the non ECEC assets and ECEC greenfield pipeline.

It is unclear as to how long it will take for the Trust to reach its new 50 per cent of ECEC assets equilibrium relative to the broader portfolio is but notably the Trust has been content to run down their development portfolio at a time when its smaller listed peer Arena REIT has elected to pursue the opposite strategy, signalling that their intentions lie outside of ECEC.

That being said, Charter Hall’s portfolio optimisation activities were not just limited to acquisitions and disposals with the Trust successfully extending the leases on 106 Goodstart Early Learning leases to an average of 20 years.

Rental growth of 2.3 per cent at lower end of historic range but more acquisitions likely

The Trust reported like for like rental growth of 2.3 per cent for the year which is at the lower end of the last seven years with the more muted performance also matched in completed market review which saw an increase which came in slightly higher at 2.6%, although only one review was finalised in the period.

Overall however, the Trust has significant capacity to continue to build out its portfolio with $300 million remaining in its current debt facility and a current gearing level of 24.5 per cent. Future acquisitions will enable the group to continue to grow with the funds expected to be channelled towards non ECEC assets as it pursues its diversification strategy.

The Trust signalled optimism regarding its FY22 outlook and barring any unforeseen events or a further deterioration in the COVID-19 environment and provided distribution guidance of 16.7 cpu, an increase of 6.4% from FY21.

To review the results announcement click here.

Popular

Practice

Provider

Quality

Research

Workforce

New activity booklet supports everyday conversations to keep children safe

2025-07-10 09:00:16

by Fiona Alston

Quality

Practice

Provider

Research

Workforce

Honouring the quiet magic of early childhood

2025-07-11 09:15:00

by Fiona Alston

Quality

Practice

Provider

Workforce

Reclaiming Joy: Why connection, curiosity and care still matter in early childhood education

2025-07-09 10:00:07

by Fiona Alston