More evidence CCS fee caps not restraining fee increases as LDC enrolment growth creeps higher

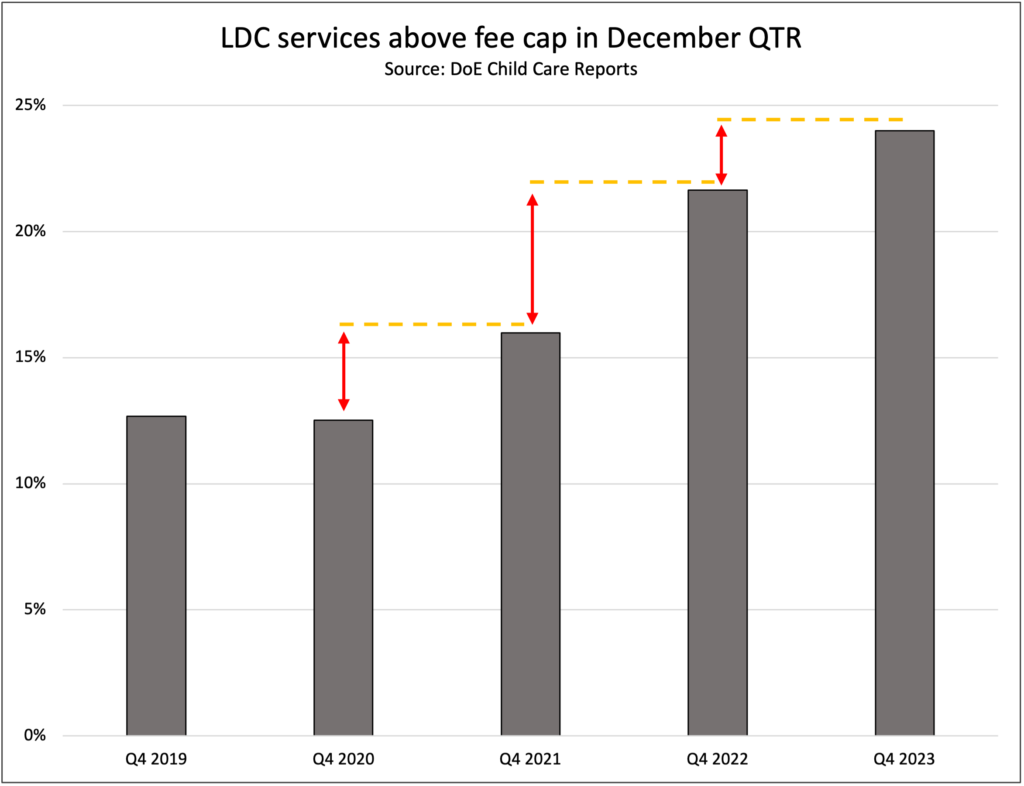

The percentage of long day care (LDC) services with hourly fees above the fee cap of $13.73 rose to 24 per cent in the December 2023 quarter, the highest level for the final quarter of the year recorded since the introduction of the Child Care Subsidy in July 2018.

The data, released as part of the Department of Education’s quarterly Child Care in Australia series, highlights just how difficult it has been to constrain provider fee increases against the backdrop of higher costs and additional subsidy being channeled into the sector.

The December quarter recorded 24 per cent of LDCs pricing their services above the $13.73, or (assuming a ten hour day) $137.30 a day, compared to 22 per cent in 2022, 16 per cent in 2021 and 13 per cent in 2020.

The measure is closely watched by policy makers with both the ACCC Report into the ECEC market and the Productivity Commission’s Review of the same calling out the efficacy of fee caps to constrain prices rises.

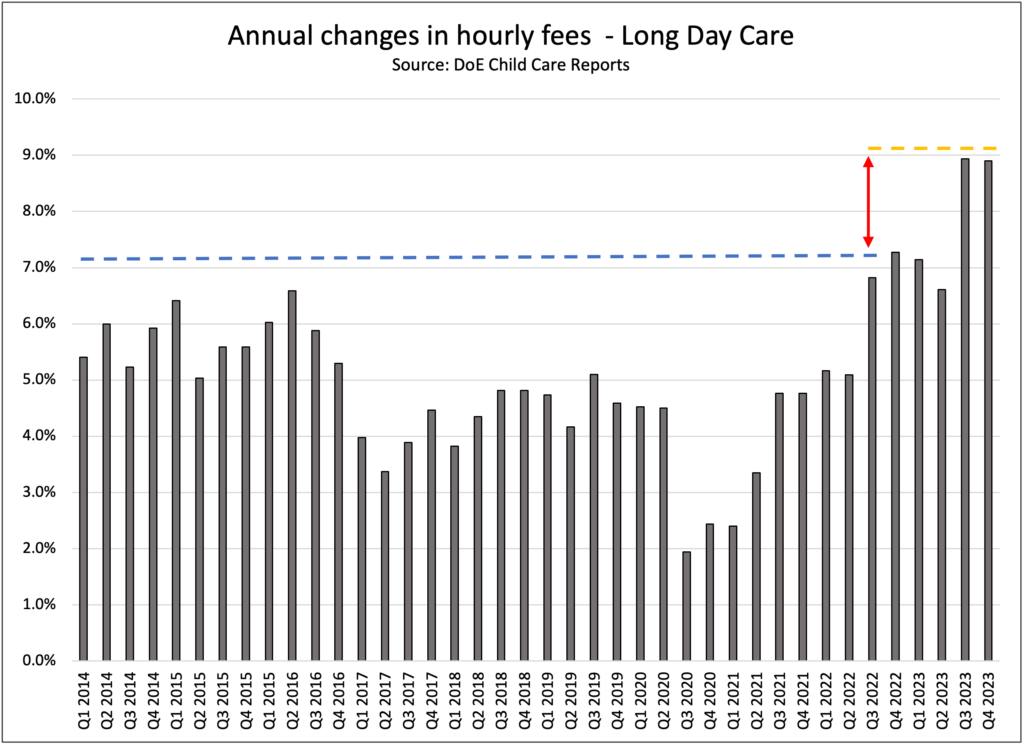

Fees across the LDC sector rose 8.9 per cent year on year, the second consecutive reading of above 8.0 per cent. The levels of increase were just ahead of Family Day Care and Outside School hours care where fees rose annually 7.3 per cent and 8.8 per cent respectively.

Although there is abundant evidence that out of pocket expenses have actually fallen materially since the introduction of Prime Minister Anthony Albanese’s signature Cheaper Child Care reforms the issue of ECEC affordability is likely to remain front and centre as a Federal Election looms and the Productivity Commission’s Final report comes due.

LDC enrolment growth rises 1.7 per cent but average attendance per centre still falling

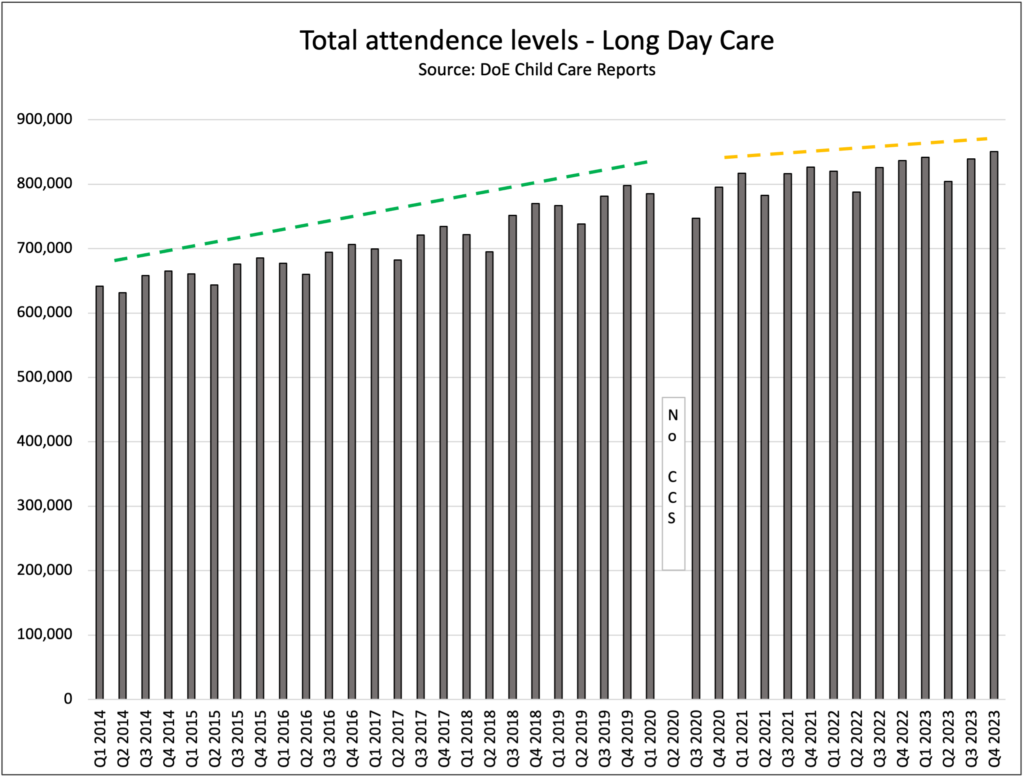

Against the backdrop of higher fees but lower out of pocket expenses enrolments in long day care (LDC) services did move moderately higher in the December 2023 quarter according to the Department of Education’s Child Care in Australia data series.

A total of 850,900 children enrolled in an LDC service over the period, around 1.7 per cent higher than last year and 1.4 per cent higher than the previous quarter.

Although any growth is likely to be welcomed by the early childhood education and care (ECEC) community, the muted growth in the wake of the very substantial increase in Child Care Subsidy (CCS) post the Cheaper Child Care reform implementation will be a concern, especially when compared the 4.0 per cent and more enrolment increases recorded in the immediate aftermath of the CCS introduction in July 2018.

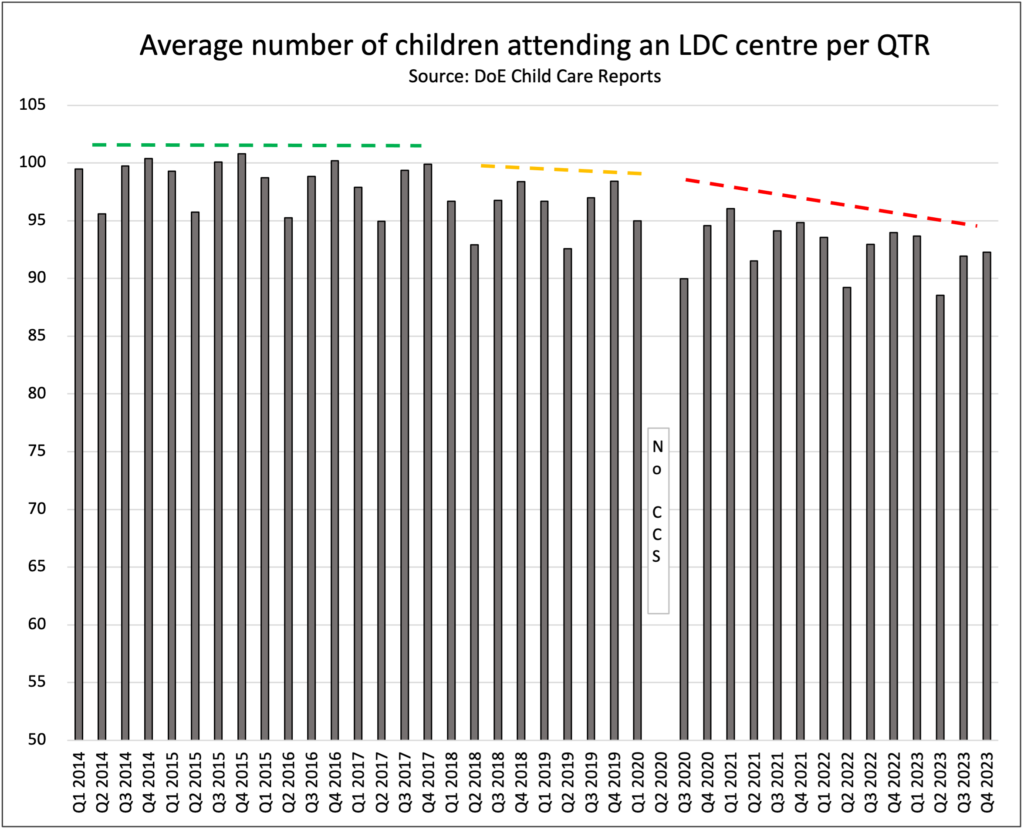

Against this backdrop, new centre openings which are now rising at 3.6 per cent a year, well above current enrolment growth rates, are perpetuating a trend that has been in place for some time where average attendance per centre drifts lower.

New supply concerns have been on the back burner for a number of years as cost inflation and delivery delays combined to limit new centres being opened. Despite some of these constraints still being in place, new centres are opening at an apparently faster rate.

Should this accelerate without a pick up in enrolment growth then competition concerns are likely to become a dominant theme in the second half of 2024 and beyond.

Access the Department of Education’s quarterly Child Care in Australia series here.

Popular

Workforce

Policy

Quality

Practice

Provider

Research

ECEC must change now, our children can’t wait for another inquiry

2025-07-02 07:47:14

by Fiona Alston

Practice

Provider

Quality

Workforce

Leading with Curiosity: How distributed leadership is redefining the future of early childhood education

2025-07-03 07:42:07

by Contributed Content

Events News

Workforce

Marketplace

Practice

Quality

Provider

Research

An exclusive “Fireside Chat” with ECEC Champion Myra Geddes

2025-07-01 11:25:05

by Fiona Alston