Charter Hall REIT reports modest HY22 operating results, maintains growth by acquisition strategy

Charter Hall Social Infrastructure Fund REIT (CQE) has reported its Half Year 2022 results in which it reports modest improvements in operating performance on a year on year basis whilst increasingly focussing on acquisitions as a means to generate growth.

Net property income was up 12.6 per cent to $40.1 million and operating earnings up 5.8 per cent to $30.8 million in the first half as moderate like-for -like rental growth of 2.6 per cent and substantial increase in operating expenses muted overall returns.

The Trust acquired twenty three centres over the reporting period with eighteen having settled by 31 December 2021 and the balance expected to settle in the first quarter of 2022. The acquisitions will contribute to an increase in the overall portfolio to 327 owned centres and 33 leased centres.

“CQE has continued delivering on its strategy of improving the portfolio quality and metrics to enhance income and capital growth for Unit holders,” Fund Manager Travis Butcher said.

“Continued portfolio curation and capital management ensure CQE is well positioned to maintain security of earnings and capitalise on future growth opportunities”.

Like sector peer Arena REIT portfolio revaluations at cycle highs, yields at lows

In a similar approach to sector peer Arena REIT who reported results last week, the Charter Hall Social Infrastructure Fund was particularly active on the revaluation front with a sizeable $175.4 million, 11.9 per cent, increase in asset values, of which the early childhood education and care (ECEC) component of the portfolio was marked up by 13.2 per cent.

The passing yield of the childcare portfolio is now 5.0 per cent, a new low, and 13 basis points lower than Arena REIT’s portfolio of 256 properties.

Charter Hall noted that “Capitalisation rates continue to compress for social infrastructure assets, reflecting limited supply and ongoing strong demand for long WALE assets in “essential sectors with stable income” as an explainer for the valuation boost, although no mention was made of current macro inflation concerns and by extension early indications that the interest rate cycle has likely turned.

The total ECEC portfolio is now valued at $1,506 million, up from $1,171.4 million, an increase of 28.6 per cent as acquisitions and revaluations kick in.

Balance sheet gearing continues to tick higher even after substantial revaluations

The Trust’s total borrowings divided by total assets, adjusted for contracted childcare acquisitions and disposals, the completion of the childcare development pipeline and payment of December quarter distribution, now stands at 30.0 per cent.

This level of gearing is the highest reported for at least seven years, and reflects a big jump in drawn down debt to $565 million and notably remained high despite the very substantial increases in portfolio valuations in the period.

Although debt maturity is concentrated in FY2027 with $500m, five years from now, the prospects of an equity raise to recalibrate this key balance sheet metric cannot be ruled out.

Notably, the percentage of debt hedged is now at 54 per cent, also a relatively low level, given concerns around interest rate trajectories adds an additional level of uncertainty to the Trust’s balance sheet and overall financial risk.

Development pipeline still in run off as preferred strategy remains buy instead of build

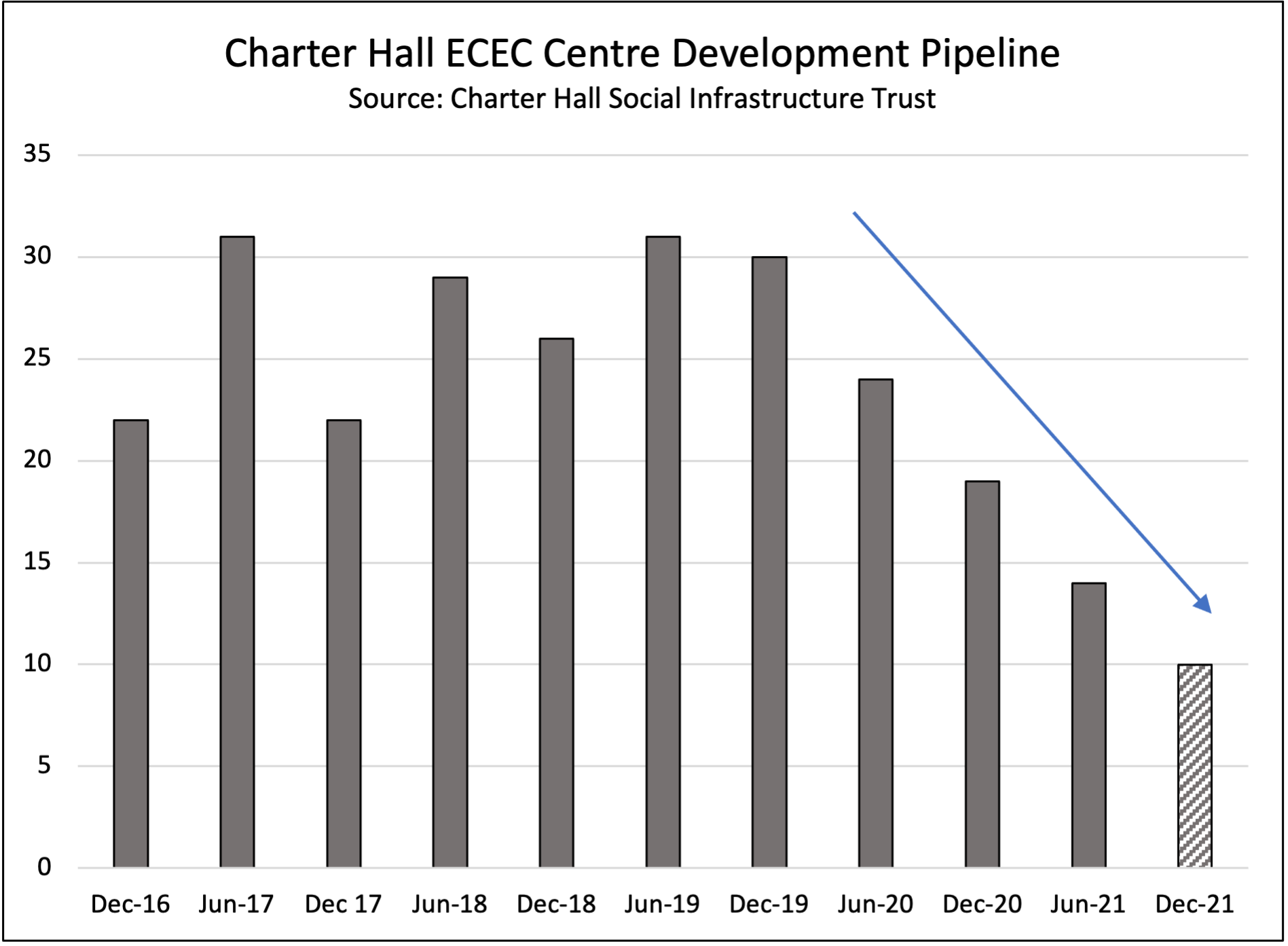

Charter Hall’s ECEC development pipeline has fallen to just ten centres, as four completions in the period, valued at $28.3 million were transitioned to the main portfolio and no new developments added to the pipeline.

The pipeline is now less than one third of that reported pre COVID-19 with the Trust displaying very appetite in rebuilding and instead preferring to focus growth efforts on acquiring completed, leased assets such as the eighteen Western Australian centres it bought in December 2021.

The strategy being deployed is in stark contrast to Arena REIT who have built a pipeline that is now at record highs in terms of numbers of sites and underwrites the very different strategies currently being pursued by the two organisations.

To read the half year results announcement click here and review the presentation click here.

Popular

Economics

Policy

Provider

Workforce

Prime Minister Albanese backs Tasmanian Labor’s childcare plan, highlights national early learning progress

2025-06-30 10:42:02

by Fiona Alston

Economics

Provider

Quality

Practice

Policy

Workforce

South Australia announces major OSHC sector reforms aimed at boosting quality and access

2025-06-30 09:49:48

by Fiona Alston

Events News

Marketplace

Practice

Provider

Quality

Research

Workforce

How do you build and keep your dream team? ECEC Workforce and Wellbeing Forum tackles the big questions

2025-06-24 15:20:53

by Fiona Alston