Charter Hall upbeat about ECEC prospects in half year report

Charter Hall Education Trust (CQE), the ASX listed real estate investment trust specialising in early education centres formerly known as Folkestone Education Trust, has released its half year report in which it sounds an upbeat note on sector fundamentals despite reporting a dip in statutory profits.

In particular, the report confirmed better affordability levels post the implementation of the Child Care Subsidy (CCS) as a driver for increased demand for early learning services and cited anecdotal evidence indicating that January occupancy levels driven by stronger CCS driven re-enrollments were up between 2 to 3 per cent on the same period last year.

Nick Anagnostou, Head of Social Infrastructure said “The sector is experiencing improving participation rates and there is greater overall affordability for parents via the CCS regime.”

The report went on to note that a more stable supply outlook is expected in 2019 as bank lending criteria tightens further, local councils become more discriminating when evaluating development approvals and operators remain cautious of portfolio expansion, and that to some degree developers have already responded to the more restrictive conditions with the number of new Long Day Care openings falling substantially in Q4 2018.

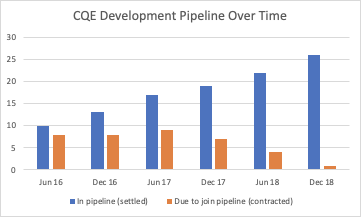

This more subdued supply outlook has also been reflected to some degree in the Charter Hall pipeline which as at 31st December 2018 contained only one new contracted site compared to four in June 2018, seven in December 2017 and eight or more in June 2017, December 2016 and June 2016 respectively.

Mr Anagnostou noted that although the group considers development sites to be an important renewal element for the sector, CQE has slowed contracting new sites because of challenges finding “proper opportunities and also increased difficulty in getting development applications” which has resulted in the drop experienced.

A reduction in the number of sites being contracted to join the pipeline signals discipline is being prioritised over growth which over time, if maintained, will lead to a fall in the rate of new centres being opened by the group which will ultimately support their comments on future supply dynamics abating.

Other key highlights of the report included:

- Statutory profit, impacted by a lower revaluation uplift, came in at $42.2 million as compared to $55.4 million in the same period last year

- Distributable income increased 1.0 per cent to $21.2 million and net tangible assets per unit by 3.2 per cent to $2.87 compared to last year

- The benefits of a 5.6 per cent increase in lease income was mitigated by a jump in finance costs of $1.1 million due to the cost of higher average debt levels

- Like for like rental growth across the portfolio was 2.6 per cent taking into account market and annual reviews

- A debt refinance exercise completed in August contributed to an extension of overall debt maturities from 2.4 to 4.6 years

- Tenant profile by percentage of annual rent saw exposure to Goodstart Early Learning continue to fall and Only About Children and other operators tick higher

- Portfolio yields fell to 6.2 per cent as at December 2018, a fall of 10 bps from June 2018 and 30 bps on June 2017

- The group acquired one property in the period and sold four

Overall Mr Anagnostou noted that “CQE re-positioned its portfolio over the last 3 years in recognition of pending industry change. We profited from asset sales and although there was a subsequent impact on the first half’s earnings growth, we are now well placed to target new opportunities with conviction.”

Popular

Policy

Practice

Provider

Quality

NSW Government launches sweeping reforms to improve safety and transparency in early learning

2025-06-30 10:02:40

by Fiona Alston

Quality

Provider

Policy

Practice

WA approved provider fined $45,000 over bush excursion incident

2025-07-01 07:00:01

by Fiona Alston

Economics

Marketplace

Provider

The new AI powered feature making lives easier for families and service managers

2025-07-01 09:00:59

by Fiona Alston