KPMG, UNSW Business and PwC team up to help small business

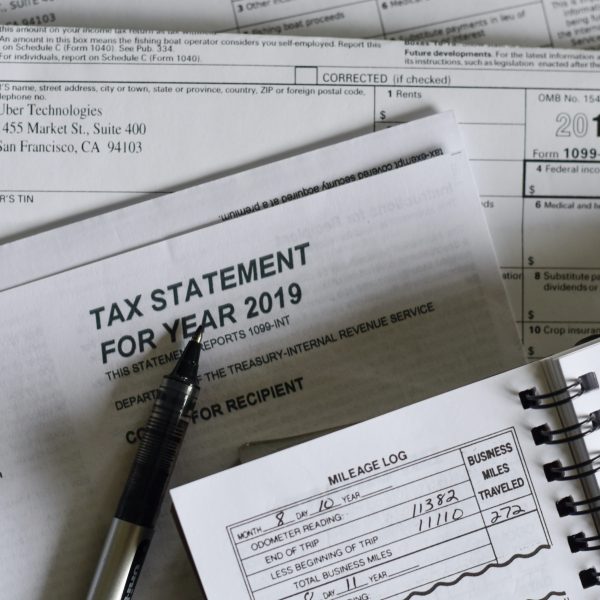

Without doubt, the 2019/20 financial year has been one of significant shift and change. The withdrawal of CCS, the advent of JobKeeper, various payroll tax changes and other impacts such as revenue decline from a chaotic summer of fires will leave many businesses, including those operating in early childhood education and care (ECEC) wondering how to handle the shifts and changes come tax time.

Knowing this, UNSW Business School is working with PwC Australia and KPMG Australia to help small businesses navigate their tax obligations and the relief available amid the COVID-19 pandemic.

The UNSW Tax Clinic is offering free, independent and confidential tax advice for people and small businesses in genuine financial distress, as part of an ongoing initiative with professional service firms PwC Australia and KPMG Australia.

Dr Ann Kayis-Kumar, co-founder of the UNSW Tax Clinic and senior lecturer at the UNSW Business School anticipates demand for support will be high this year.

“Tax clinics present a unique opportunity for the tax profession to engage in grassroots, skills-based volunteering. We’re proud of our new alliances with PwC Australia and KPMG Australia, and grateful for their generous support” she added.

PwC Australia will offer over 30 individual volunteers from their Sydney office for the cause – Australia’s largest pro bono tax professional cohort from a single professional services firm.

“This is an extremely challenging time for many small businesses, and having access to expert advice is more important than ever. We are delighted to be able to partner with UNSW Business School on this initiative to help make a real difference to those who may be under pressure at this time.” PwC Australia Tax Partner Ali Noroozi said.

KPMG Australia will continue to provide a regular secondee from their Tax Controversy team to bolster the team of experienced tax professionals and student volunteers. UNSW Business School students will receive hands-on experience helping the wider community and develop their tax technical skills, all while being mentored by experienced professionals.

Speaking on behalf of KPMG, Angela Wood, KPMG Australia’s Head of Tax Dispute Resolution and Controversy said the opportunity to continue to partner with UNSW Business School in assisting the Tax Clinic’s clients, especially now as so many are facing into difficult times, is a high priority for KPMG Australia.

UNSW Tax Clinic is ready to help people from across NSW in financial hardship as a result of the recent natural disasters, including the drought, bushfires, floods, and the COVID-19 pandemic. All in-person client appointments have been transitioned to telephone appointments in the face of COVID-19.

Those who have been significantly affected by recent events and need tax advice but cannot afford it can contact the UNSW Tax Clinic by phone – 02 9385 8041, or email – [email protected]

Popular

Economics

Provider

Quality

$3 million boost to support flexible early learning options for NSW families

2026-01-27 07:30:19

by Fiona Alston

Economics

Provider

Stunning Sydney childcare centre sells for $11.5 million

2026-01-23 08:06:51

by Contributed Content

Economics

Policy

Provider

Expanding access to early education in regional South Australia: New investment brings services closer to families

2026-01-23 08:06:50

by Fiona Alston