Charter Hall Social Infrastructure reports steady H1 results amidst ongoing ECEC portfolio rationalisation

Charter Hall Social Infrastructure Fund has reported its Half Year 2024 results showing a 10.9 per cent increase in net property income against the backdrop of ongoing active portfolio curation, which saw the disposal of six early learning centres.

The centres were considered non-core due to their age or for competition related reasons, and raised $22.3 million at a yield of 4.6 per cent. The Charter Hall Social Infrastructure Fund now owns 358 centres and generates around 77 per cent of all rental income.

“The Fund’s property portfolio remains strong with a long WALE of 12.8 years, 100 per cent occupancy and well placed to deliver future rental growth through market reviews across 46 per cent of the portfolio in the next five years,” Fund Manager, Travis Butcher said.

“The quality of the portfolio was demonstrated through the divestment of six childcare assets at a premium of 8.8 per cent to previous book value.”

Operating income strength mitigated by spike in finance costs

Charter Hall Social Infrastructure Fund generated $52.9 million in the six months to December 2023, up 10.9 per cent on the previous year as acquisitions made in the second half of FY2023 combined with rental increases of 3.5 per cent pushed returns higher.

However, a significant increase in finance costs from $12.2 million to $16.6 million, up 36.1 per cent, served to neutralise the top line performance and contributed to operating earnings coming in flat year on year, at $29.6 million.

Higher finance costs were largely a function of rising interest rates, as opposed to increasing debt levels. The Fund reported debt of $731.5 million, down $739.0 million last year, with the proceeds of the sale of centres directed towards reducing debt outstanding.

Balance sheet gearing stands at 32.5 per cent, below target gearing range of 30 – 40 per cent but towards the top of the actual range reported over the last eight years.

ECEC organic portfolio continues to shrink, development sites down to three

Post the divestments the Fund owns 358 centres, representing 77 percent of all rental income generated, with Goodstart Early Learning still the Fund’s largest tenant paying 33 per cent of income.

G8 Education and Only About Children contribute 8 per cent each, with Busy Bees Australia the next largest early childhood education and care (ECEC) contributor at 4 per cent with the early learning portfolio now valued at $1,706 million and the average centre valuation up slightly to $4.85 million.

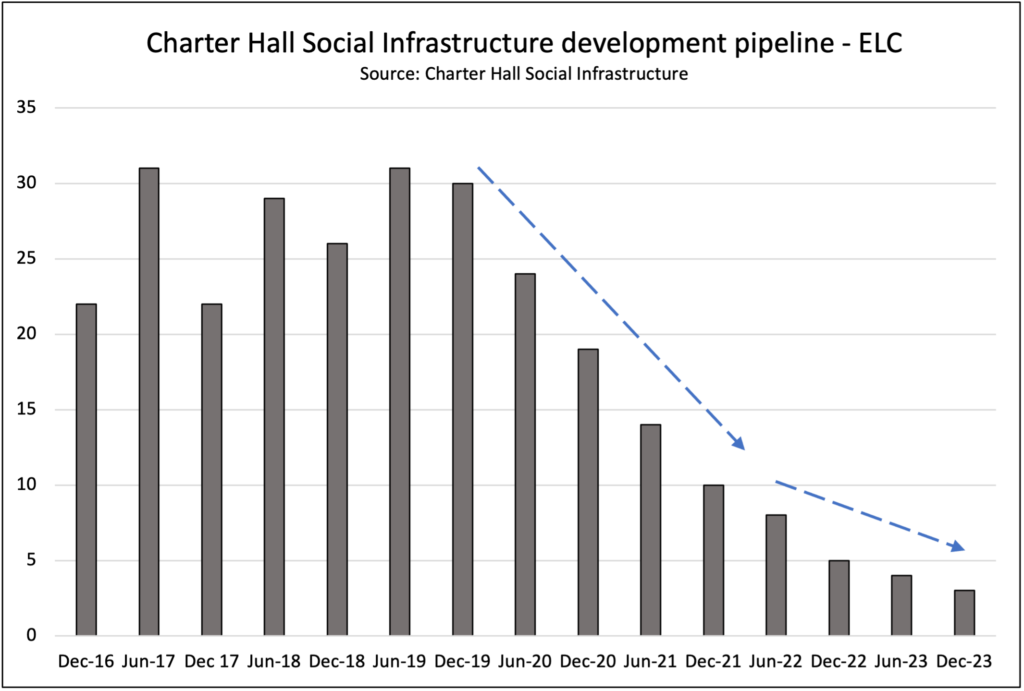

Of particular note in these results is the ongoing drawdown on the development pipeline within the Trust. As of December 2023 there were just three development sites on the books, with one of them earmarked for divestment later this year.

The pivot away from building to buying freeholds has been in play for several years, with no sign that the strategy is likely to change in the near future.

This may bode well for operators across the ECEC sector at large concerned about increasing supply of new long day care centres over the medium term. To know that the largest ECEC landlord is not actively nurturing, and delivering a sizeable greenfield portfolio of their own removes what has historically been a significant source of supply.

Popular

Practice

Provider

Quality

Research

Workforce

New activity booklet supports everyday conversations to keep children safe

2025-07-10 09:00:16

by Fiona Alston

Quality

Practice

Provider

Workforce

Reclaiming Joy: Why connection, curiosity and care still matter in early childhood education

2025-07-09 10:00:07

by Fiona Alston

Policy

Practice

Provider

Quality

Research

Workforce

Beyond the headlines: celebrating educators and the power of positive relationships in early learning

2025-07-07 10:00:24

by Fiona Alston