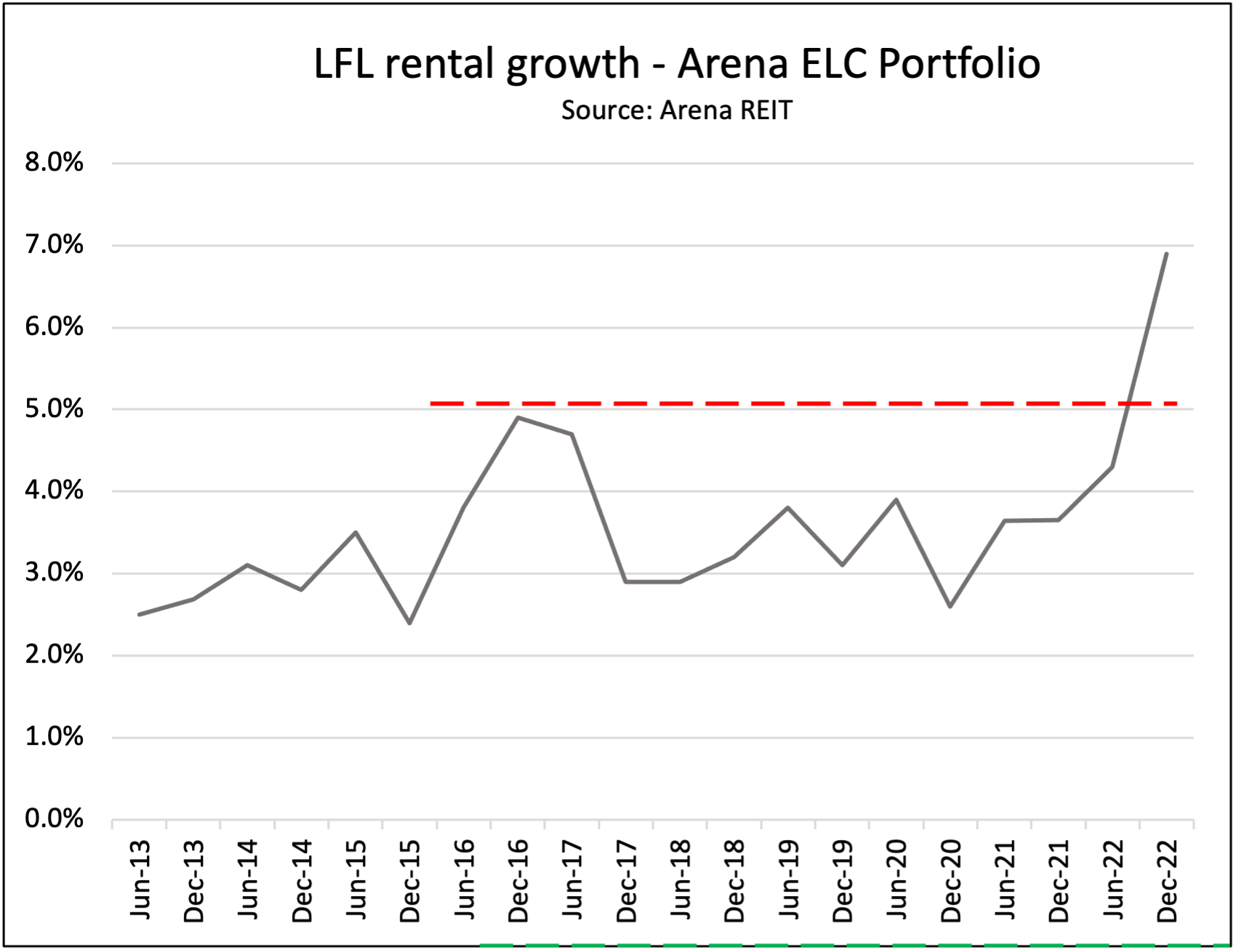

Arena REIT’s HY results highlight provider inflation challenges with 6.90% LFL rental growth

Arena REIT has reported half year 2023 results in which overall performance was supported by the largest jump in like for like rental growth across its early learning centre portfolio in a decade.

Net operating profit (distributable income) was $29.9 million, up 8.6 per cent on the corresponding period last year, and statutory net profit was $47.6 million, down 74 per cent on the prior period due largely to a significantly smaller portfolio revaluation uplift.

“Our team and tenant partners have continued to work hard during the period,” Rob de Vos, Managing Director said.

“Arena has delivered seven new high quality, purpose built early learning centres for local communities and our tenant partners continue to report strong underlying business occupancy.”

Rental growth a key drive of Arena business performance

The Group, which now owns 246 early learning centres, reported like for like rental growth of 6.90 per cent across the portfolio, 2.60 per cent higher than that reported at its Full Year 2022 results in August last year and 2.0 per cent higher than the previous high water mark registered in June 2014.

With in excess of 90 per cent of rent reviews contacted at CPI, the higher of CPI or an agreed fixed amount or via rent reviews, the Arena rental growth profile is positively underwritten by increased inflation levels with the increased rents borne by approved provider tenants.

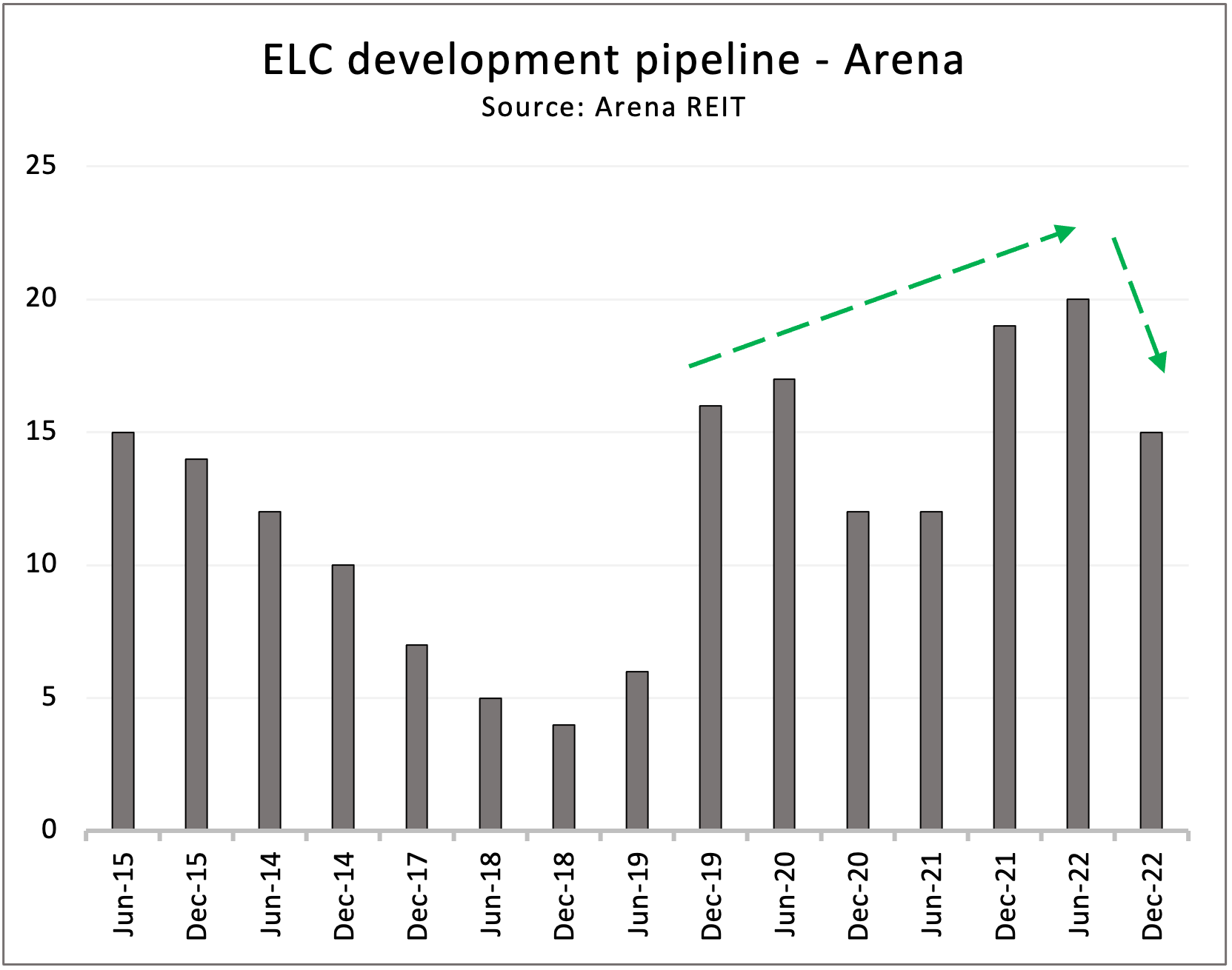

Portfolio tenants report strong environment but Arena dev pipeline off highs

99.6 per cent of Arena’s portfolio is currently leased out with tenants confirming that underlying operator occupancy is higher than any prior corresponding period over the last six years.

Despite the positive performance and sector outlook Arena’s development pipeline paired back from the record levels reported as at 30 June 2022. The Group now has 14 sites unconditionally contacted, and one conditionally contacted, compared to twenty in total last year.

The centres are likely to be completed over the next eighteen to twenty four months and are expected to cost around $106 million in total with a further $66 million in capex due, a figure which is more than covered by existing cash and borrowing capacity.

“Strong social and macroeconomic drivers continue to support the Australian ELC sector,” amedia release from Arena noted before adding, “Record female workforce participation rate has been driving demand for services and increased long day care participation over the medium to long term.

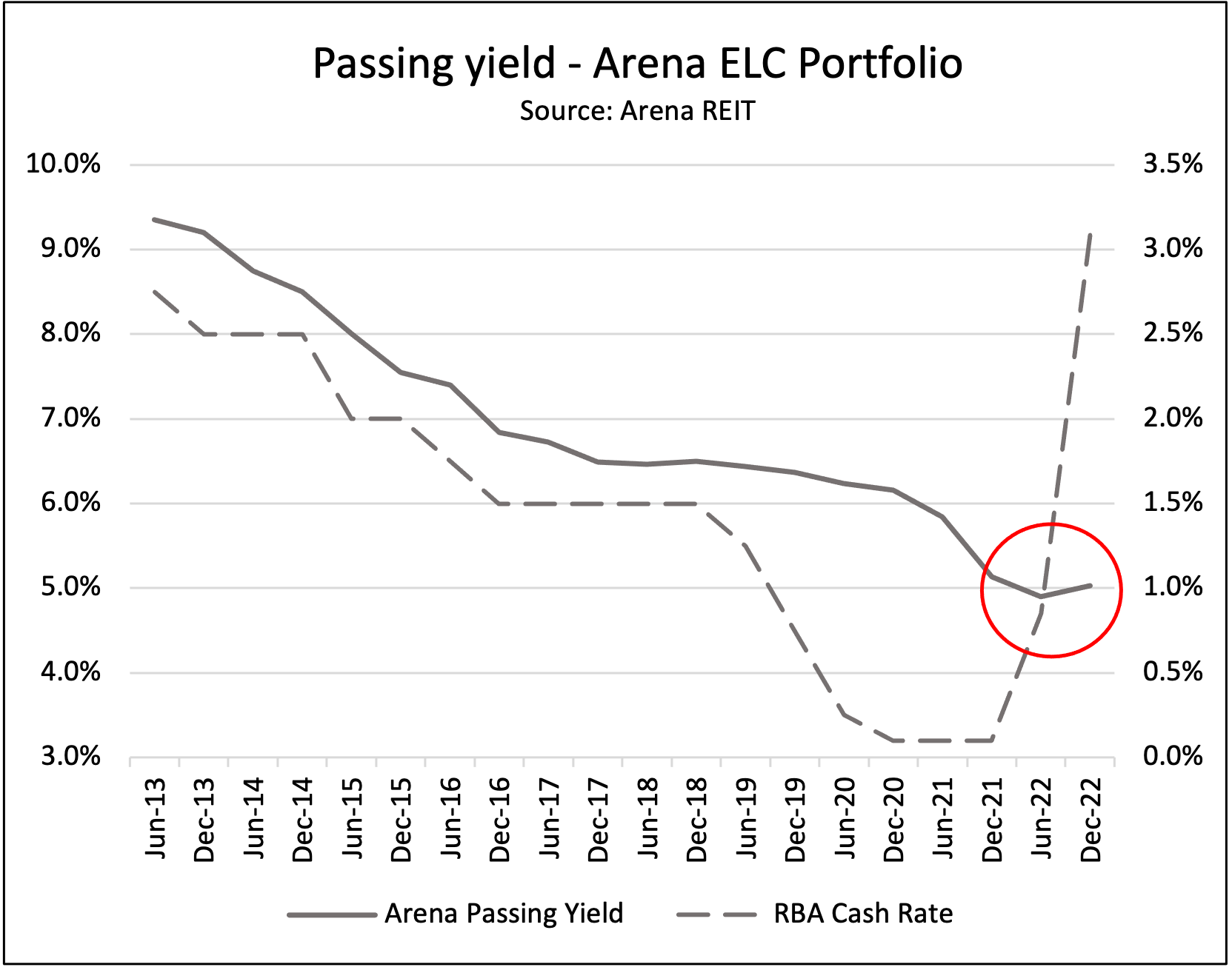

Portfolio revaluations less impactful as passing yields rise for first time in 10 years

The early learning portfolio of 260 centres benefited from a revaluation increase of $19 million, an increase of around 1.5 per cent, and very materially lower than the substantial $232 million increase passed June 2022.

The portfolio’s passing yield closed the period at 5.03 per cent, 13 basis points higher than June, and the first such increase in portfolio yields recorded in at least a decade.

Of particular note is the very significant divergence between the direction of the RBA’s cash rate, which is currently sharply higher, and Arena’s passing yield which after tracking the cash rate closely for the last 10 years remains only marginally off its low level of 4.90 per cent.

Arena’s balance sheet metrics appear solid, with gearing at 21.5 per cent and around $150 million of credit still available. However, their cost of debt has risen substantially from 2.9 per cent to 3.9 per cent in the period. Interest cover remains at 5.7x.

To read the half year results announcement click here and to review the presentation click here.

Popular

Policy

Practice

Provider

Quality

Spot checks, CCTV and scrutiny of Working With Children Checks: sector responds to child safety crisis

2025-07-07 07:15:26

by Fiona Alston

Quality

Practice

Provider

Research

Workforce

Honouring the quiet magic of early childhood

2025-07-11 09:15:00

by Fiona Alston

Policy

Practice

Provider

Quality

Workforce

Minister Jess Walsh signals urgent action on safety and oversight in early learning

2025-07-11 08:45:01

by Fiona Alston