Arena REIT FY22 results – Rentals, acquisitions and revaluations drive growth, dev pipeline now at cycle highs

Arena REIT has released a solid set of FY2022 results as rental income, acquisitions and revaluations combine to drive growth, whilst also maintaining momentum in its early childhood education and care (ECEC) development pipeline.

The Group posted a rise in net property income of 11 per cent to $66.6 million and net operating income of $56.3 million, an increase of 8.4 per cent, both of which were new records. A round of substantial revaluations also pushed statutory net profit to a new record of $334 million, an increase of 102 per cent on the prior year.

“The COVID-19 pandemic continued to present challenges for our tenant partners during FY22 and more recently a changing economic environment arising from inflationary pressures, interest rate increases, wages pressures and staff shortages have combined to create further uncertainty,” Arena’s Managing Director Mr Rob de Vos said.

“We acknowledge these challenges and express our gratitude to our tenant partners for their continued resilience and ability to deliver essential services to Australian communities and our team for their commitment and performance during FY22.”

Rental increase, acquisitions and development site completions drive performance

Average rent increases across the ECEC portfolio were 4.3 per cent in FY22, compared to 3.6 per cent in FY21 with around 80 per cent of FY23, FY24 and FY25 rent reviews contracted at the higher of CPI or an ’agreed fixed amount’ providing the group with some insulation from current jumps in inflation.

Rent as a percentage of a tenant’s revenue was reported at 10.6 per cent, compared to 11.0 per cent last year.

Over the course of FY22 Arena acquired seven operating ECEC centres for $47.4 million at a yield of 5.4 per cent and also completed six development sites, which were subsequently transitioned to operating status, at a cost of $35.9 million.

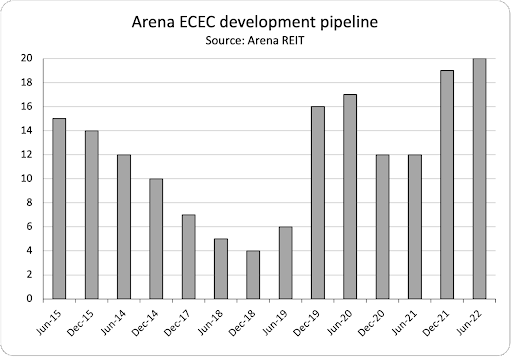

The development portfolio, including those contracted subject to planning or other conditions, now stands at 20 sites, up one since the last half year and eight since last year.

Arena has shown a consistent appetite to maintain and sustain a strong development pipeline unlike its larger peer Charter Hall Social Ventures REIT who over time has drawn down its pipeline and instead opted to drive growth through acquisition and rental means.

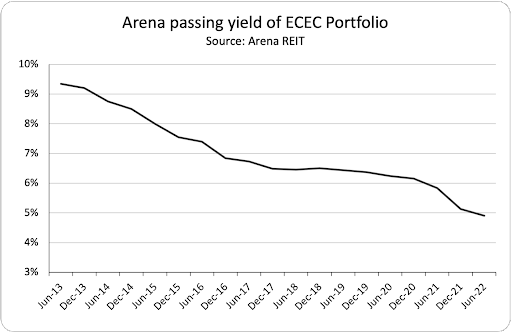

ECEC portfolio revaluations turbo charged in FY22 with yields now at record lows

As at 30 June 2022, Arena’s portfolio of 237 ECEC properties was valued at $1.3 billion, a 34.0 per cent increase on the same period last year, with the revaluation component of the increase amounting to $232 million, or an increase of 24.2 per cent.

The increase was driven by passing yields being set at 4.90 per cent, down 94 basis points from the same time last year and nearly half of those recorded back in 2013 and despite a series of larger than normal interest rate increases from the Reserve Bank of Australia and a near doubling of 10 year Government bond yields in the last six months.

From a balance sheet perspective Arena held $22.2 million cash on the balance sheet and long-term debt of $322.5 million. Debt increased by $84 million in FY22 with current facility limits of $430 million implying significant additional credit lines available if required.

“Arena continues to operate well within its banking covenant requirements. We have expanded our liquidity while maintaining hedging discipline through the cycle with sustained capacity to pursue investments consistent with strategy,” Chief Financial Officer Mr Gareth Winter said.