LDC centres opening at slowest rate in five years according to latest ACECQA snapshot

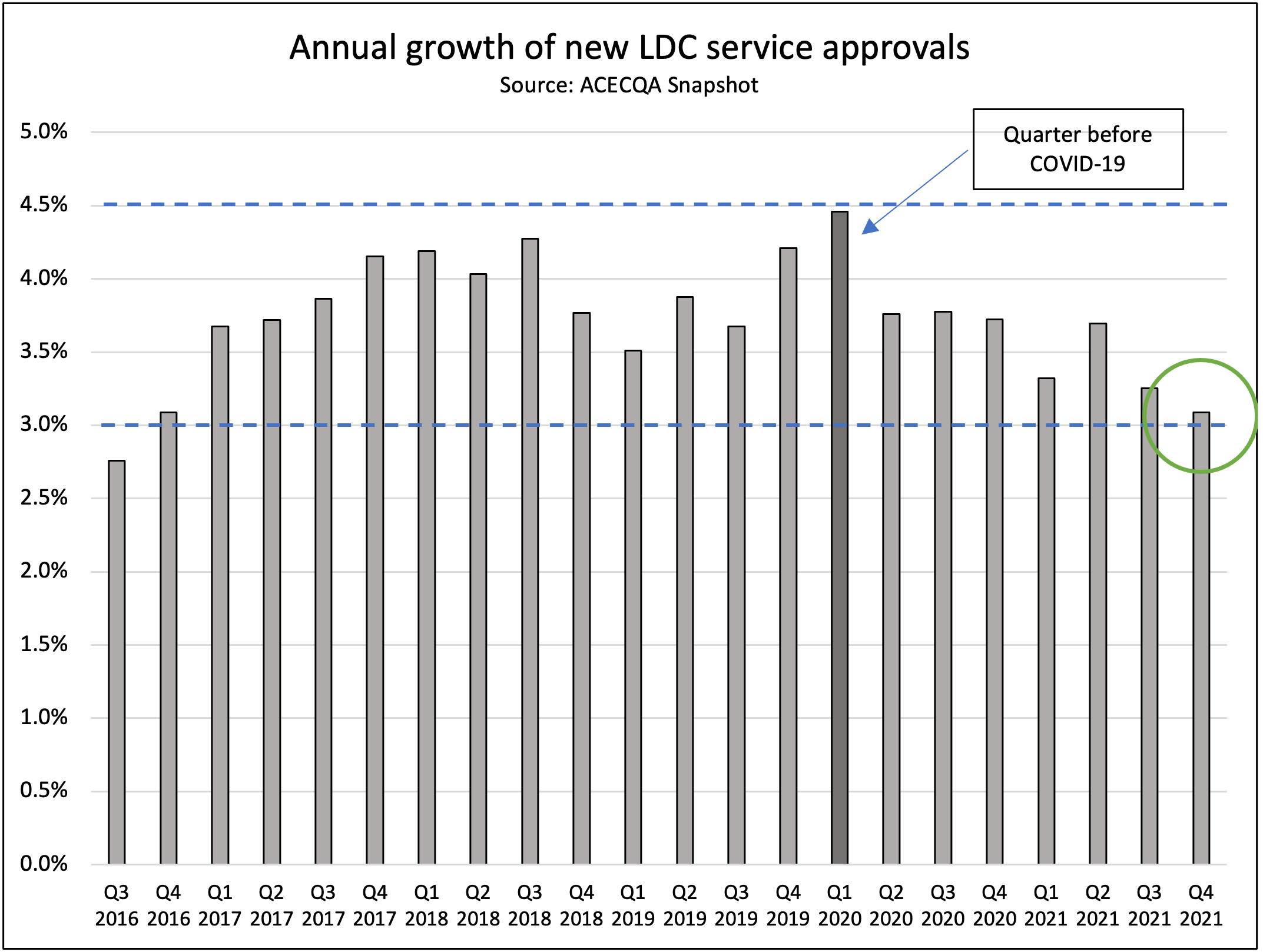

The growth in supply of new long day care (LDC) centres across Australia rose just 3.1 per cent year on year, the slowest rate of growth in five years, according to the Australian Children’s Education and Care Quality Authority’s (ACECQA) latest NQF Snapshot although signs that market participants are readying new supply have surfaced.

65 new LDC services opened across Australia in the three months ended December 2021 compared to the same period last year with the total number of services now operating rising to 8,441, an increase of 3.1 per cent year on year which equals the lowest annual growth rate since late 2016.

Although still a relatively high clip in absolute terms, 3.1 per cent is a marked reduction on the average increases in new LDC supply experienced in the last five years and most likely signals a market response to uncertainty surrounding the implications of COVID-19 on demand, extended lockdowns in the larger states in mid 2021 and supply chain and labour shortages impacting the construction industry.

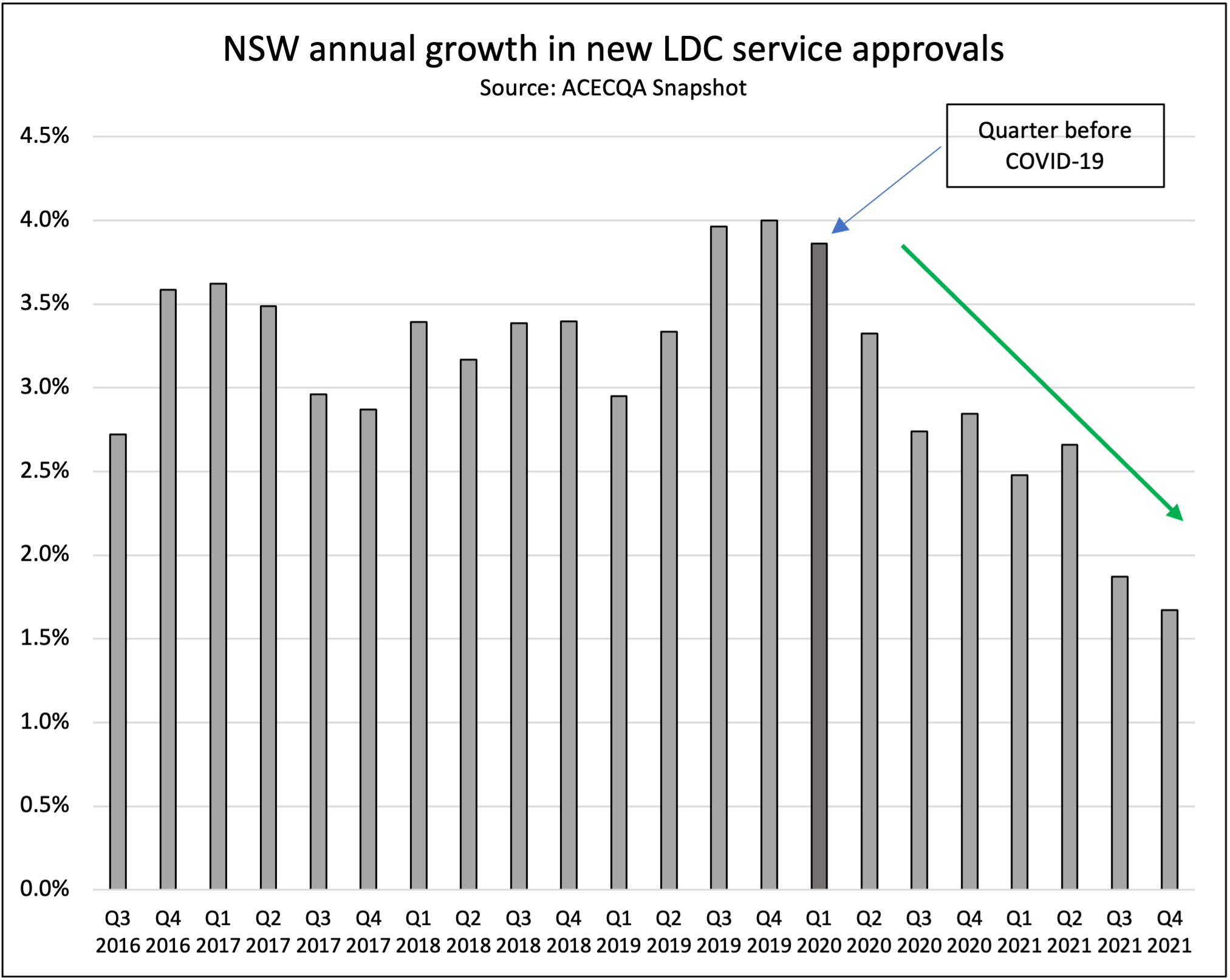

New South Wales illustrates the dynamic well with growth rates now at less than 50 per cent of what they were in Q1 2020, just before the pandemic hit. Given the size of the NSW market, it accounts for around 40 per cent of all LDCs in Australia, it is naturally acting as a weight on the broader market.

That being said, activity has also been subdued in other states with only Western Australia recording growth rates meaningfully above their five year average. Victoria grew at 5.1 per cent compared to a five year average of 5.7 per cent, Queensland grew at 3.4 per cent compared to a five year average of 3.2 per cent and South Australia grew at 2.6 per cent compared to a five year average of 4.0 per cent.

Despite new LDC supply readings hitting cycle lows market participants active in space

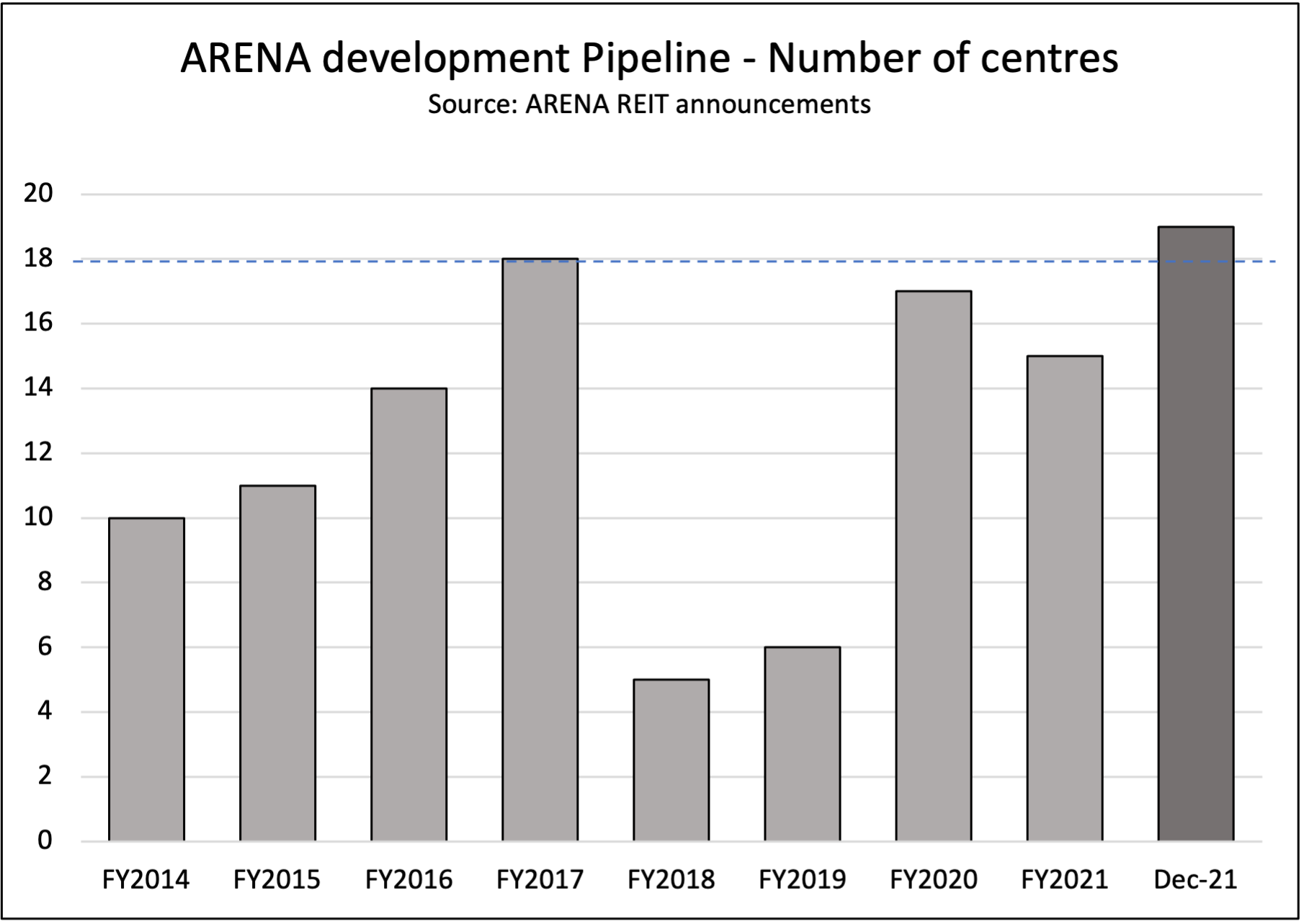

With the number of new centres opening now probing longer term cycle lows levels it is notable that some key market participants have been positioning their portfolio in the opposite direction and are instead building development site inventory or raising capital to build inventory which will ultimately find its way onto the market and more than likely start to lift supply rates again.

ARENA REIT is the an example of this with the specialist ECEC landlord confirming in December 2021 that their development pipeline of LDC centres has reached new record levels over and above the previous high point recorded in 2017.

These centres are currently either pre-construction or in construction but ultimately will find their way on to the market as open centres and assuming ARENA Reit is a reasonable proxy for developer activity the relative level of new supply in the pipeline will be sufficient to lift supply rates going forward.

Another example of potential supply build is the recent news that South Australian property developer Accord had raised $25 million for a new fund that will focus on building a portfolio of as many as eighty centres, a substantial amount of new supply, over the next five years.

Family Day Care and Preschool supply trends still negative

Regardless of how market participants are positioning their development pipelines, as it stands LDC supply growth is at cycle lows which is a positive backdrop for operators on the assumption that demand trends remain stable and staffing bottlenecks overcome.

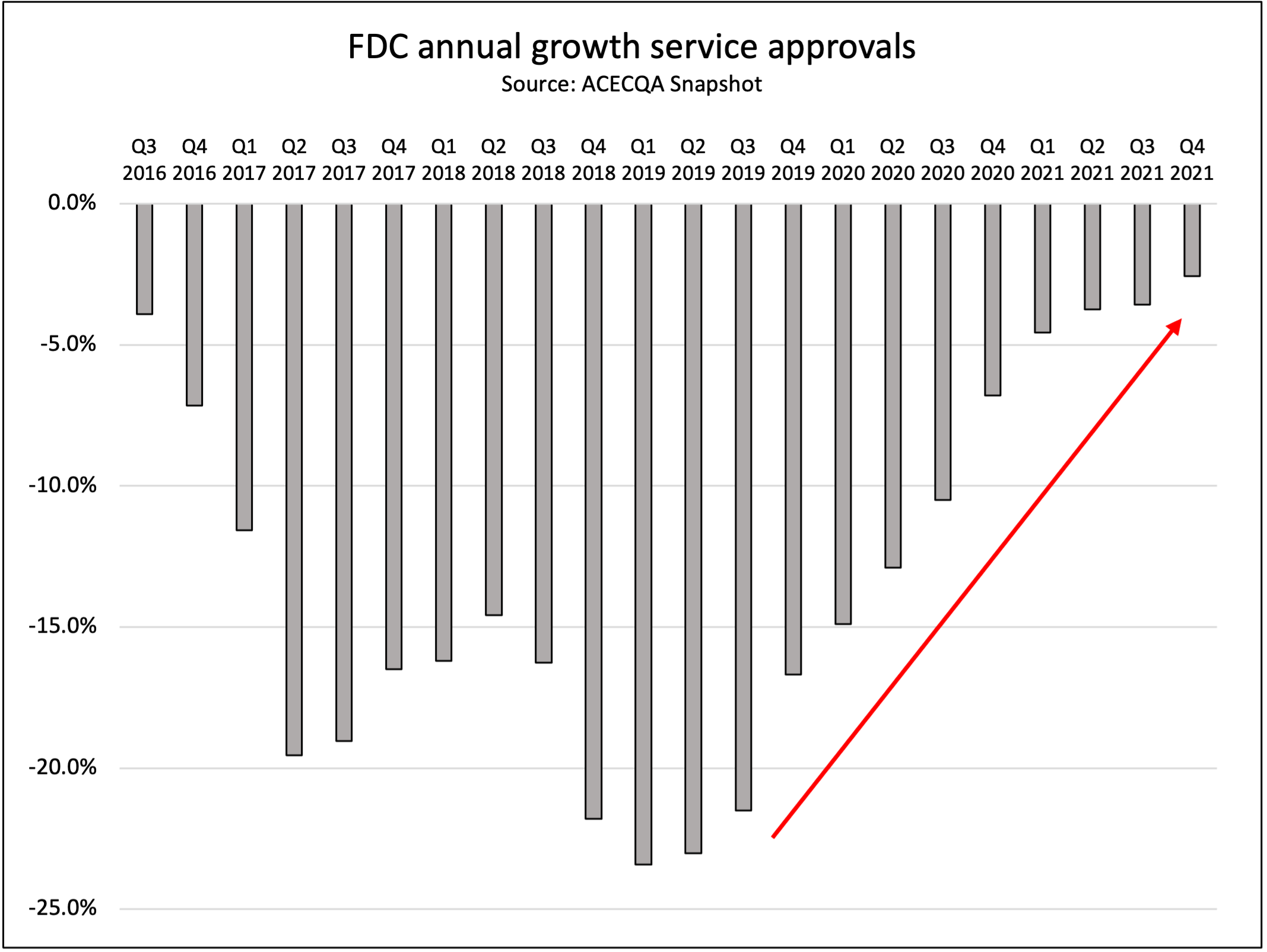

With regard to competition from other ECEC settings both Family Day Care (FDC) and Preschool new service openings continue to fall with both recording negative growth rates for the last quarter of 2021 with the former down 2.6 per cent and the latter 0.5 per cent.

FDC however is certainly signalling a degree of stabilisation after the massive contraction in services operating since 2016 whereas Preschools, which have not been subjected to such an acute drawdown, continue to contract within the – 1.5 per cent to 0 per cent range that has been in place for the last several years.

To read this quarter’s snapshot please click here or launch the Online NQS Snapshot here.

Popular

Policy

Practice

Provider

Quality

NSW Government launches sweeping reforms to improve safety and transparency in early learning

2025-06-30 10:02:40

by Fiona Alston

Quality

Provider

Policy

Practice

WA approved provider fined $45,000 over bush excursion incident

2025-07-01 07:00:01

by Fiona Alston

Workforce

Policy

Quality

Practice

Provider

Research

ECEC must change now, our children can’t wait for another inquiry

2025-07-02 07:47:14

by Fiona Alston