Charter Hall REIT reports HY2020 results, confirms development pipeline at multi year lows

Charter Hall Social Infrastructure Fund REIT has reported its Half Year 2021 results in which it reported solid operational and financial performance as well as confirmed its ECEC greenfield pipeline continues to draw down to multi year lows.

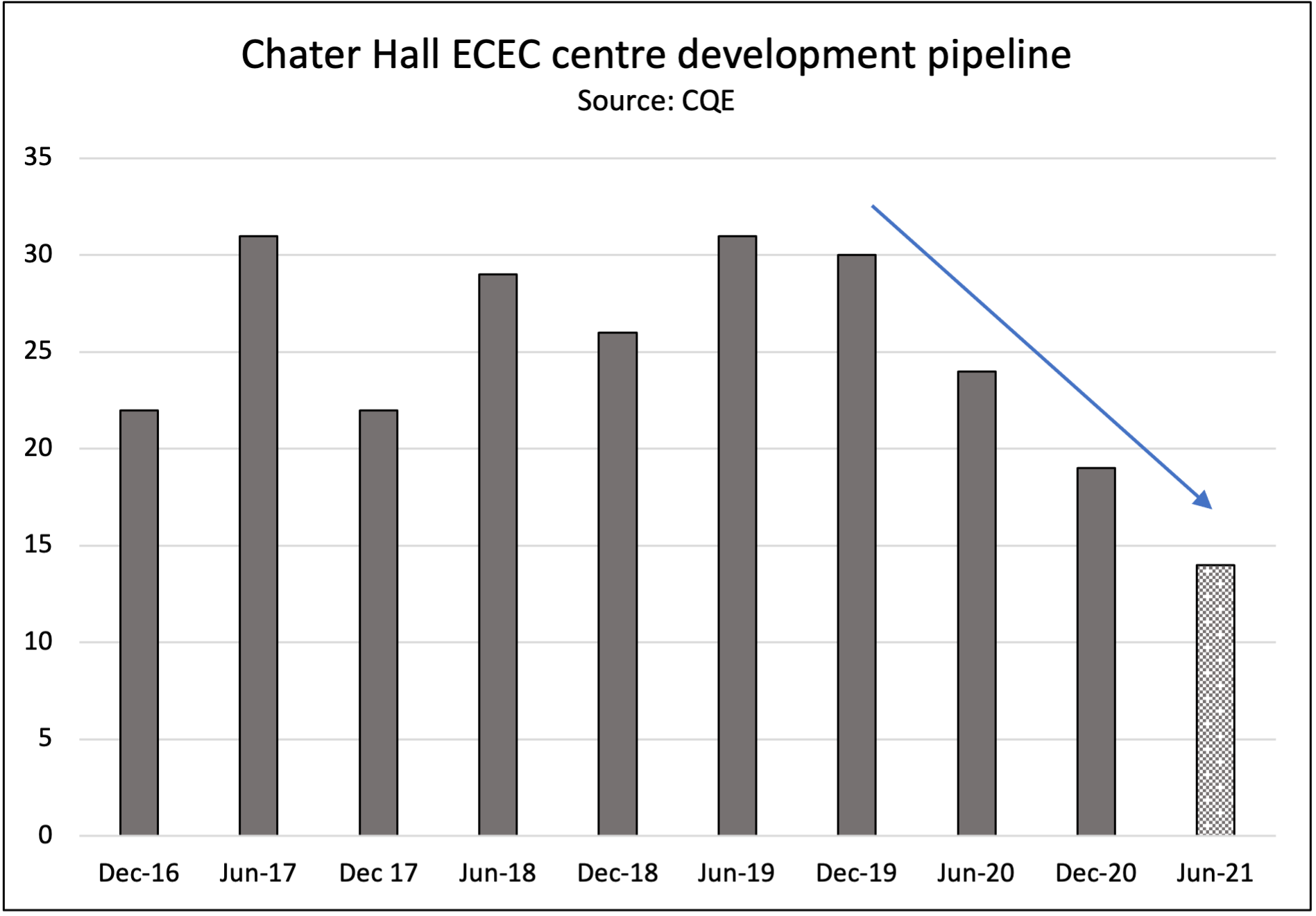

The total pipeline now consists of 19 centres with five centres expected to deliver in the next six months which, in the absence of any efforts to top up the pipeline, will see 14 centres remain, more than 50 per cent lower than levels recorded in mid 2019.

Although it is unclear whether this drawdown is a strategic objective of Charter Hall or not, it is notable given concern in some quarters of the sector that supply growth is likely to be a real sector headwind in coming years.

Divestment strategy continues in H12020 as New Zealand assets contracted to sell

As reported in December 2020, Charter Hall has agreed to sell 20 ECEC properties that were leased to New Zealand’s largest ECEC provider Best Start for a total of NZD40.1 million.

In addition, ten other centres have been contracted to sell, with eight of them expected to settle by June 2021, taking the total divestments in the period to 30 centres.

Overall the REIT still has 376 centres spread across Australia, with its largest tenant Goodstart Early Learning leasing 45 per cent or 169 centres of their centres.

On a separate note, Charter Hall was able to secure 58 new leases with Goodstart which extended the average terms on the leases from 12 to 20 years and saw a conversion to fixed annual increases as supposed to variable.

The extensions helped the REIT’s weighted average lease expiry (WALE) move out from 12.7 years to 14.0 years.

Diversification into non ECEC assets continues with two significant transactions

As part of Charter Hall’s strategy to diversify their portfolio into other social infrastructure assets it acquired two new properties in the first half of FY21.

Firstly, an eleven story building in Newstead, Brisbane to be leased to Mater Misericordiae Ltd, Queensland’s largest not for profit health provider and secondly, a new emergency services command centre that will be leased to the South Australian Government on completion.

The total to be spent on these purchases will be $202.5 million after which a total of $130 million will be available to invest in further assets as required.

Operational and financial performance in period on track

The Trust generated $34.4 million of net property income in the period, an 8.2 per cent increase on last year that was made up of $2.1 million (4.1 per cent) rental increase growth and a $2.1 million (4.1 per cent) contribution from acquisition activity.

Net operating income was up 8.2 per cent to $36.8 million with total operating earnings up 14.1 per cent as costs such as finance, fund management fees and administration expenses fell in aggregate over the period.

340 valuations were conducted, a significant number and materially higher than the last several years, resulting in a 2.4 per cent revaluation up lift to 2020 carrying values being passed.

Notably, Charter Hall confirmed that transaction yields continue to fall in their view, with average levels of 5.8 per cent being recorded across 162 transactions since June 2020.

The Trust’s balance sheet remains supportive of short term liquidity needs and future growth aspirations, with around $25 million of cash and $130 million of available debt facilities.

To view half year 2020 investment presentation please click here.