Policy

Grattan Institute recommends 95% CCS subsidy ceiling

Jason Roberts

Jun 30, 2020

Save

Grattan Institute, a leading public policy think tank, has released its latest report titled “The Recovery Book - What Australian governments should do now” in which it recommends that the Child Care Subsidy rate should be increased and the taper rate flattened to improve affordability and encourage a smoother transition for families with young children to return to work.

The commentary on early childhood education and care (ECEC) acknowledges that the free childcare policy measure adopted by Government in the wake of COVID-19 had been supportive of working parents through the crisis but acknowledged that “maintaining the crisis arrangements was never an option.”

However, the report goes on to say that “a sudden stop to the scheme in July is likely to be tough for many parents, childcare centres, and childcare workers” as affordability challenges reemerge acting as a deterrent for families to maintain their children’s attendance, which in turn puts pressure on ECEC services.

In addition, the report spends some time examining the incentive structures built into the current Child Care Subsidy system and concludes that actually, contrary to its intent of facilitating workforce participation, the system creates a disincentive for some families to work more largely due to the cost of child care.

The example used in the report is that of a household with two young children where one parent works full time and the other part time. If the part time working parent wanted to increase their days work from three days to four days, the report concludes that 90 per cent of the extra days wages would be lost due to additional child care costs, taxes and a corresponding reduction in family payments.

Due to these structural challenges, and a recognition that a wholesale change of the current system is unlikely, the Grattan Institute recommends two key policy changes:

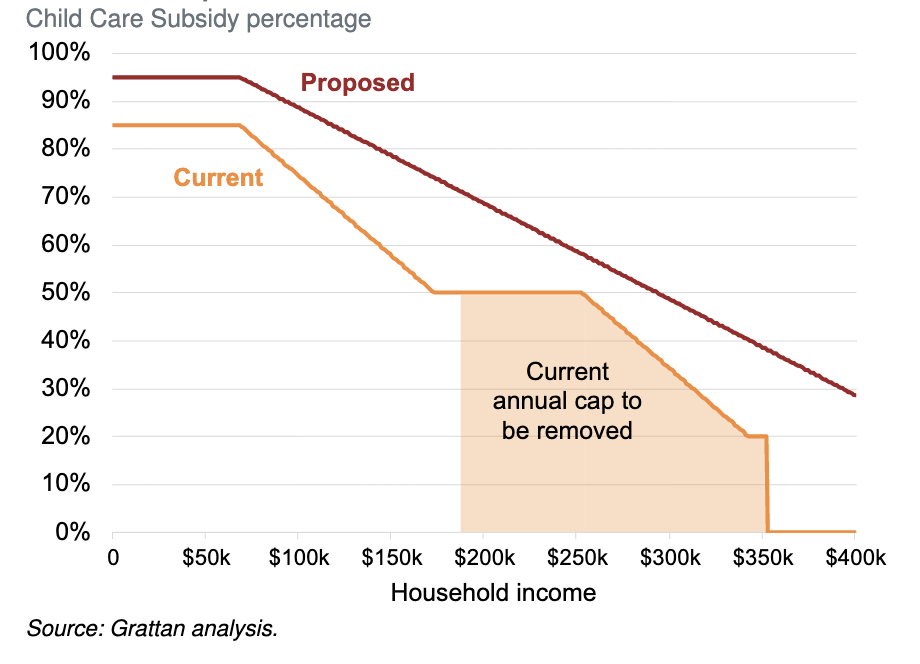

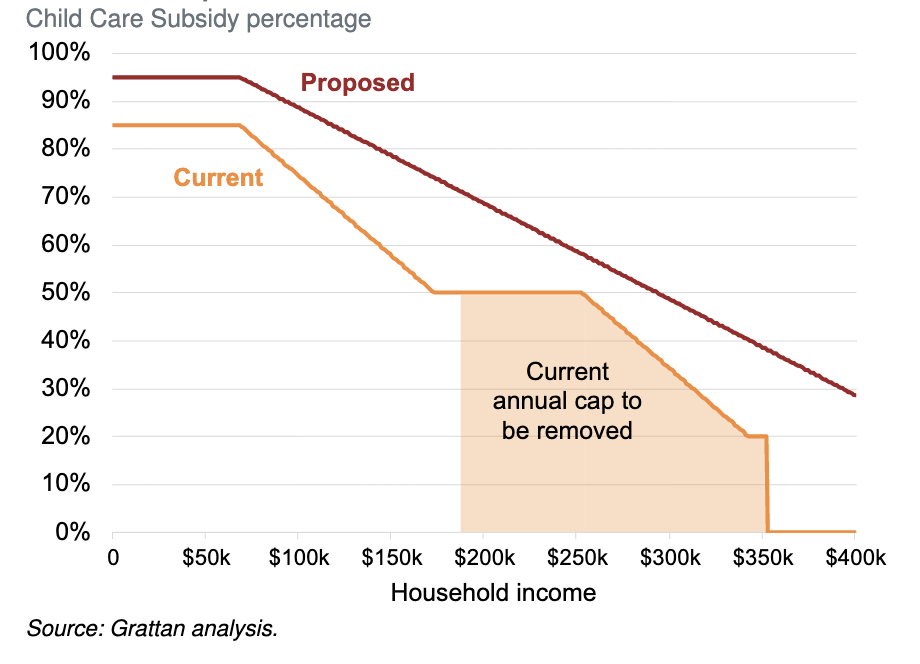

- Lifting the maximum Child Care Subsidy threshold for lower income families to 95 per cent from the current 85 per cent

- Introducing a flatter tapering of subsidy entitlement as household income rises and eliminating the current annual cap

The result, the Grattan Institute posits, would support the return of existing demand for care and create an incentive, as opposed to a disincentive, for families to assume more work going forward at a cost to Government of an additional $5 billion but yielding an $11 billion higher workforce participation dividend.

Notably, the report did not mention removal of the activity test as a recommended policy measure but did acknowledge Government's relaxation of activity test requirements until October as a positive.

To read the Grattan Institute's report please click here. The section discussed in this article can be found on pages 64 to 67.

Don’t miss a thing

Related Articles