Economics

Affordability & Accessibility

New Child Care Subsidy rate confirmed, and due to commence 1 July 2019

Freya Lucas

Jun 20, 2019

Save

The Federal Department of Education has confirmed the revised Child Care Subsidy (CCS) rates which will take effect from 1 July 2019.

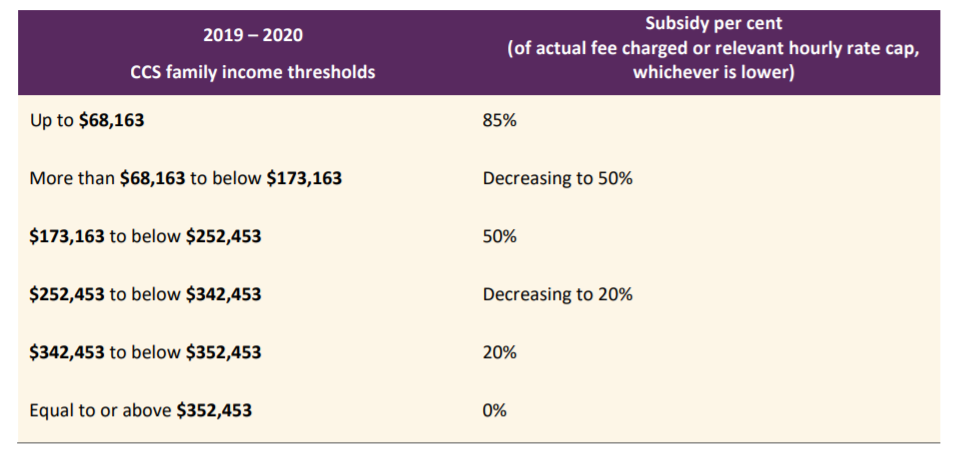

The percentage of CCS to which a family is entitled will continue to be based on combined annual income, and has been adjusted in accordance with the Consumer Price Index (CPI).For the 2019/20 financial year, the following income thresholds will apply from 1 July 2019:

Source: CCS 2019 review factsheet

Source: CCS 2019 review factsheet

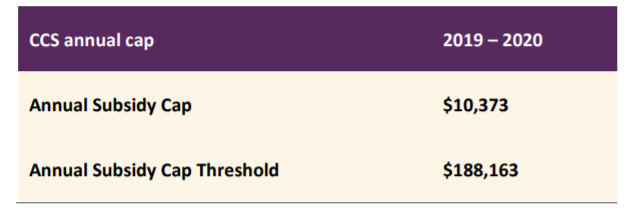

There is no annual cap for most families receiving Child Care Subsidy. The income threshold at which an annual cap does apply, and the value of the cap, are adjusted annually in accordance with CPI. The table below shows how the annual cap applies from 1 July 2019.

Source: CCS 2019 review factsheet

Source: CCS 2019 review factsheet

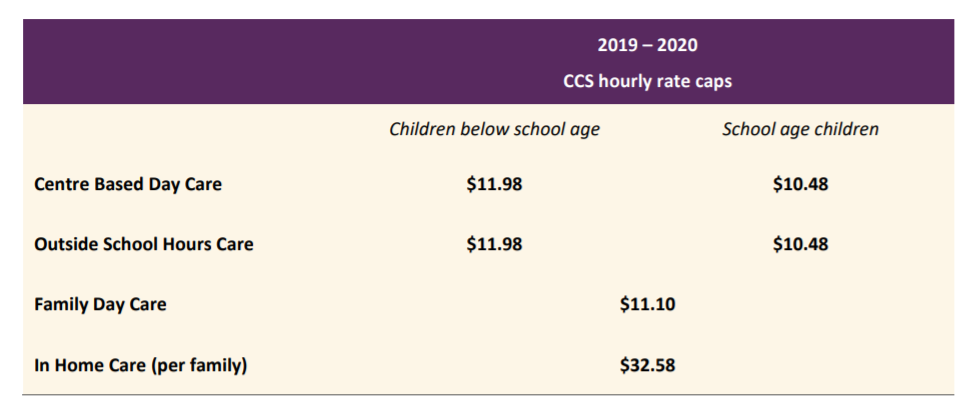

The hourly rate caps are the maximum hourly rate used to calculate families’ Child Care Subsidy for each service type. The hourly rate caps are adjusted annually in accordance with CPI. The table below shows the hourly rate caps that apply from 1 July 2019. Source: CCS 2019 review factsheet

Source: CCS 2019 review factsheet

A fact sheet in relation to the above is available here.

Don’t miss a thing

Related Articles